Top reasons why businesses lose trust after acquisition and how you can be smart

Did you wake up to the news that your favorite tool was acquired? You probably got used to the tool's intuitive interface, cost-effectiveness, and feature set, which aligned perfectly with your day-to-day requirements.

Your disappointment doesn't end here. It's just the beginning of a series of potential negative consequences of acquisitions.

We have seen customers share their pain on acquisitions

Acquisition by a networking giant

A large networking company acquired a tool known for its customer-friendly culture and usability. Users complained about a significant reduction in customer support, making the tool less user-friendly and the representatives less accessible.Acquisition by a cloud provider

A major cloud provider acquired a tool with a history of frequent new feature releases and integrations. Users reported a significant slowdown in development after the acquisition. Bug fixes became less frequent, and new features prioritized the cloud provider's ecosystem, leaving users concerned that the tool was no longer keeping pace with their broader needs.Acquisition by a larger software company

Users of a cost-effective tool were unhappy with a substantial price increase after the acquisition. Additionally, the acquiring company's broader data collection practices raised concerns about the security and privacy of their data within the newly acquired tool.

Why do customers lose trust?

Several factors erode the trust of customers following their acquisition. However, here are the major ones:

- Changing priorities: The acquiring company always has different priorities. It may focus on gains after acquisition, align with its own products and roadmap, or prioritize integrations. This may neglect the acquired company's product roadmap and bug fixes altogether.

- Innovation stagnation: The development of the acquired tool might slow down as the resources may be diverted. This could be due to a need for more focus on new features and a stagnated development trajectory. This may disappoint the existing user base, who expect to see updates to the tool and wait forever for the requested features.

- Pricing change: Purchasing a tool depends not only on its quality and features but also on its affordability. Budget constraints influence the choices at all levels, and those who choose a cost-effective tool may have to face a significant price hike after acquisition.

- Privacy and security concerns: Choosing a tool involves rigorous legal, security, and privacy checks, and the policies no longer remain the same after acquisition. The acquiring company's data collection and storage policies might be less transparent, leading users to be in total darkness about who accesses their data.

Another factor that loosens an extra layer of security is when the original tool is in a highly data-secure region and the acquiring company is from a region with minimal security focus and policies.

Choose wise

It would be wiser and easier to choose a user-centric tool with a lower acquisition risk. Here are a few factors to consider:

The long haul

Look for a tool with a clear long-term vision and goal focusing on advanced technologies and concepts, inventing new features catering to user needs. Tools that have a strong foundation by themselves are the ones with a clear vision.Financial stability

A financially stable company is less likely to undergo acquisition. Research the background and financial records before you decide on the purchase.Focus on R&D

Choose a company whose core business values align with latest technologies and product development. Companies that invest at least a portion of their profit in R&D and those that use their own product for internal needs are clear winners.Company culture

Look for a company that prioritizes user feedback and is committed to customers. An easy way to identify this is through the strength and accessibility of the support and community systems. A company that provides unrestricted customer support via different mediums is more reachable, and one that listens to customers via online communities, responds to them, and comes up with the requested features is genuinely customer-centric.

Eliminating the risk factor

Here's your quick checklist to eliminate tools with high risk of acquisition:

- Look for independent vendors with a strong record. These companies are less of a target for acquisition.

- Engage with online communities to understand user feedback and longevity of the product.

- Put the new players on hold till they stabilize unless they have a solid company to back them up.

Why ManageEngine

With clear ideas on what to choose and what not to choose, here is why ManageEngine could be the right tool for you.

Longevity and a strong customer base

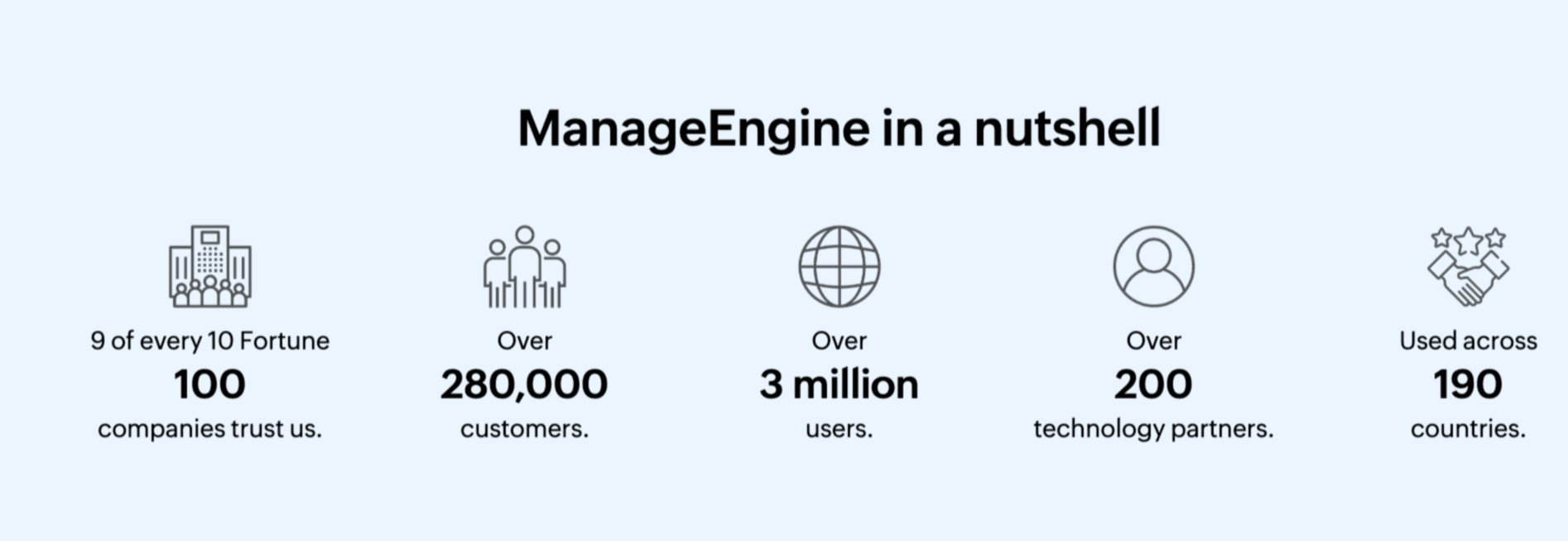

ManageEngine has been in the market for over 20 years, with a solid user base catering to organizations of all shapes and sizes. Read Zoho's vision. | Know our customers.

A strong foundation

ManageEngine is a division of Zoho Corporation, a 25-year-old privately held product company with no exit or acquisition plan.

Accountability to our customers

At ManageEngine, the customers are the most important stakeholders, and their continuous belief fuels our success. To uphold this commitment steadfastly, we listen to them via the community and act on their requests, ensuring our accountability to a diverse and enduring global user community.

Commitment to privacy and security

Data privacy is both a legal issue and a moral one. GDPR-level privacy policies regarding data ownership, access, and deletion are applied by default for every account. We also ensure our stringent security protocols are rigorously tested and regularly audited.

Continuous research and development

On average, ManageEngine invests 60% of its revenue in research and product development. Focusing on value and quality, we channel user fees directly into deepening our feature offerings, compounding value year after year.

Deep customizability

From individual UI elements to integration with existing tools, ManageEngine's software ecosystem is flexible enough to create a perfect fit for every organization. Therefore, no customer has to adjust their workflows to fit the software.

Flexible deployment options: On-premises and cloud

ManageEngine provides both on-premises and cloud-based solutions to meet diverse IT operations management (ITOM) needs. OpManager is designed for organizations seeking on-premises network monitoring and management, while Site24x7 offers cloud-based monitoring for hybrid IT environments, ensuring comprehensive observability across infrastructure, applications, and digital experience.

In conclusion

Choosing the right tool goes beyond analyzing features and fit. Prioritizing long-term commitment, financial stability, and the user-centric culture helps with longevity. With a well-considered approach, you can choose a tool that empowers your operations and provides peace of mind for the long haul, and ManageEngine could be the one you are looking for. Try now.

Topic Participants

Santhi Santhanakrishnan